February 24, 2023

A Smooth Start (For Now)

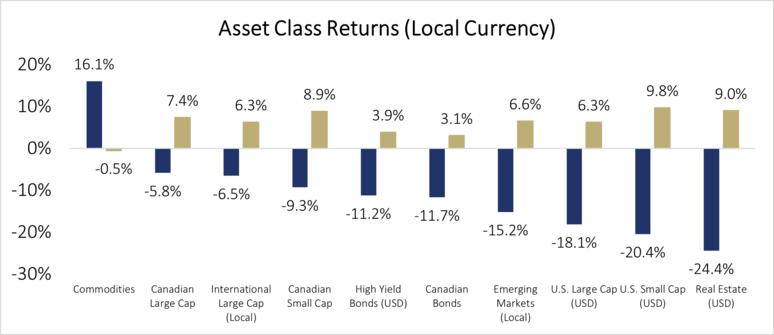

Investors’ appetites have increased as we entered 2023. Generally, at asset class level, the larger the loss in 2022, the larger the gain (recovery) in 2023, though this is only the data for January (see chart below).

What made investors so optimistic?

We recognize investors are feeling reassured by progress on several issues: First, China exited their restrictive zero-COVID policy and is now fully reopened. Second, inflation is cooling and there is confidence it will gradually decline to 3% in 2023. As a result, central banks will at least pause hiking rates in the coming months. Third, the Russia/Ukraine situation, while unresolved, is also not getting worse. Last but not least, Europe was able to maintain healthy natural gas inventory as the winter was warmer than usual, hence lower drawdown.

Source: Morningstar Research Inc., Bloomberg Finance LP, as of January 31, 2023. Asset class returns are based on the following: Commodities: Bloomberg Commodities Index TR USD; U.S. Large Cap: S&P 500 TR USD, High Yield: ICE BofAML U.S. High Yield TR USD, U.S. Small Cap: Russell 2000 TR USD, Canadian Bonds: FTSE Canada Universe Bond, U.S. Bonds: Bloomberg US Aggregate Bond TR USD, Real Estate: FTSE EPRA NAREIT Developed TR USD, Intl Large Cap: MSCI EAFE GR LCL, Canadian Large Cap: S&P/TSX Composite TR, EM Equity: MSCI EM GR LCL, Canadian Small Cap: S&P/TSX Small Cap TR, Global Large Cap: MSCI World GR LCL.

The impact on portfolios

The gains have been impressive considering the very short time frame. Our portfolios have had a similar experience: “recovery ratio” and performance were enhanced due to stronger performance in equity driven by an overweight allocation to China, small caps, and real estate. Hedging a portion of our USD exposure also added value. On the other hand, an overweight energy position was a detracting factor in January.

Will it last?

We do not expect the next 11 months to be as smooth as January. Some of the good news has been baked into asset prices, as we’ve seen from recent market rallies. We have made some adjustments including raising cash (which now has a yield of 4%), trimming bonds, and reducing Chinese and U.S. equity exposure. Cash will be re-deployed when opportunities arise but must at least beat the 4% return hurdle. This means we will probably return to purchasing equity before bonds, bearing in mind a 10-year Canadian bond only yields 3.1% today (Feb 9, 2023).

Overall, January produced impressive asset class returns as 2022’s drawdowns quickly became 2023’s gains, at least for the time being. Investors were reassured by cooling inflation, China’s reopening, Europe evading a fuel crisis, and a lack of escalation in the Russia-Ukraine war. Portfolios benefitted from allocations to China, small caps, real estate, and hedging USD exposure.

About the Author

Alfred Lam, Senior Vice President, Co-Head of Multi-Asset, joined CI GAM in 2004. He brings over 23 years of industry experience to his portfolio design, asset allocation, portfolio construction, and risk management responsibilities, which include chairing the multi-asset investment management committee and sizing investment bets to drive added value and manage risk. Alfred holds the CFA designation and an MBA from York University Schulich School of Business.

IMPORTANT DISCLAIMERS

Commissions, trailing commissions, management fees and expenses may all be associated with investments in the Assante Private Pools and the CI Funds and the use of Assante Private Portfolios. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Please read the Assante Private Pools and/or CI Funds prospectuses and consult your advisor before investing.

Assante Private Portfolios is a program that provides strategic asset allocation across a series of portfolios comprised of Assante Private Pools and CI mutual funds and is managed by CI Global Asset Management (“CI GAM”). Assante Private Portfolios is not a mutual fund. CI GAM provides portfolio management and investment advisory services as a registered advisor under applicable securities legislation.

Assante Private Portfolios is available through Assante Capital Management Ltd. (a member of Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada) and Assante Financial Management Ltd., (a member of the Mutual Fund Dealers Association of Canada) both wholly-owned subsidiaries of CI Financial Corp. (“CI”). The principal business of CI is the management, marketing, distribution and administration of mutual funds, segregated funds, and other fee-earning investment products for Canadian investors through its wholly-owned subsidiary CI GAM. If you invest in CI products, CI will, through its ownership of subsidiaries, earn ongoing asset management fees in accordance with applicable prospectus or other offering documents.

Any reference to Assante Private Portfolios performance above refers to a model portfolio with a standard geographic asset allocation and blend of investment styles including alpha. Assumptions for the model portfolio include performance of the model portfolio is based on net returns and is representative of the Class/Series E shares of the underlying Assante Private Pools, or Series A classes in the case of underlying CI Funds. The portfolios are rebalanced monthly (actual client portfolios are rebalanced when the asset allocation exceeds the thresholds identified in the prospectus). No tax implications are triggered on rebalancing. The returns of the model portfolios are not indicative of returns for clients.

Certain names, words, titles, phrases, logos, icons, graphics, or designs in this document may constitute trade names, registered or unregistered trademarks or service marks of CI Investments Inc., its subsidiaries, or affiliates, used with permission. All other marks are the property of their respective owners and are used with permission.

CI GAM | Multi-Asset Management is a division of CI Global Asset Management

Not to be reproduced or copied without the prior consent of CI Global Asset Management.