February 23, 2023

CI Mosaic ETF Portfolios: Combining the Best of Both Worlds

Investment selection is as much of an art as it is a science. While quantitative risk and return metrics are important, the best advisors also focus on the qualitative side. An important aspect of that is being able to distill the overarching strategy of a portfolio and its individual constituents into an understandable, relatable, and compelling theme for your end clients.

With the mutual fund and exchange-traded fund (ETF) universe growing larger and larger by the day, the prospect of "analysis paralysis" from having to sift through dozens of tickers to construct the right portfolio for your clients can not only be daunting but could also cost you time and money.

How We Got Here: The Evolution of ETFs

The genesis of the ETF industry can be traced back to two distinct developments in the Canadian U.S. markets during the early 1990's.

In the domestic market, the Toronto Stock Exchange (TSX) launched the "Toronto 35 Index Participation Units". Over time, this product morphed into the well-known iShares S&P/TSX 60 ETF (XIU), which is heavily traded by institutional and retail investors alike.

Down south, State Street Global Advisors launched the SPDR S&P 500 ETF (SPY) a few years later in 1993. SPY turned 30 years old on January 22nd, 2023, and is currently the largest ETF in the world in terms of assets under management and trading volume.

From there, the ETF industry grew at an incredible pace. Year-after-year, new ETF products debuted, tracking geographies like emerging markets, asset classes like commodities, and even offering exposure to alternative hedge-fund like strategies such as trend-following and market neutral.

For advisors and retail investors, the dominance of passively managed index ETFs came under fire after severe losses during 2008. While passive strategies boast low costs and track their benchmark indexes tightly, they offer virtually no downside protection. When the market takes a bath, passive ETFs follow suit. Tracking the benchmark index also meant an inability to outperform altogether.

While actively managed ETFs that picked stocks based on a manager's expertise and continuous analysis were around, they were quickly eclipsed by the advent of "smart beta", also known as "factor ETFs". These ETFs represented a hybrid between passive indexing and active management, and quickly gained prominence thanks to their transparency and lower fees.

Smart beta ETFs can be characterized by their use of rules-based, quantitative frameworks that select securities based on empirically proven risk factors or financial metrics. Commonly, these include the Fama-French factors of value, investment, profitability, and size, or others like momentum, dividend growth, and low-volatility.

The Mosaic Solution

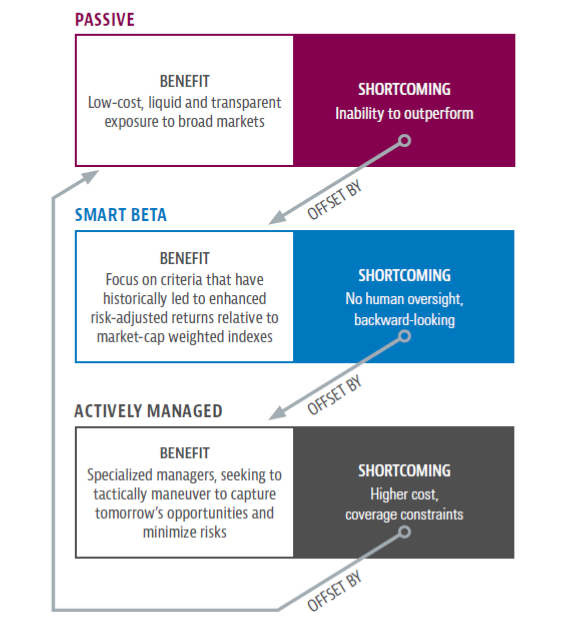

Good advisors know that there is no one-size fit all for their clients. Because the investment environment is highly dynamic, portfolio composition must remain agile as well. Here's a high-level breakdown of how active, passive, and smart beta ETFs can shore up each other's weaknesses:

That being said, managing a portfolio of multiple passive, active, and smart-beta ETFs can be difficult. A portfolio of more than just a few ETFs can quickly become cumbersome in terms of trading costs, rebalancing, and distribution management.

CI Mosaic ETF Portfolios offer a managed solution that combines CI's excellent strategic and tactical asset allocation capabilities with the advantages of both the ETF and mutual fund structure.

These funds use a particular "fund of ETFs" structure that "wraps" an assortment of ETFs into the mutual fund structure. With this approach, one can save significantly on trading commission costs while still accessing a wide range of underlying ETF strategies.

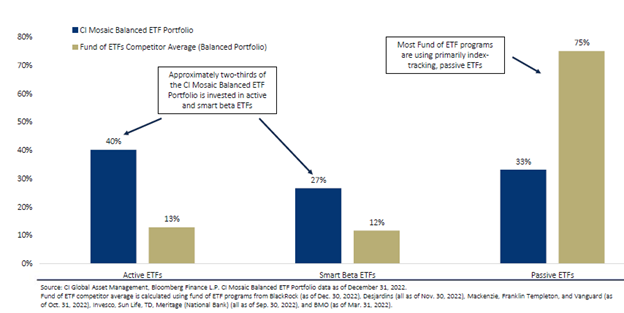

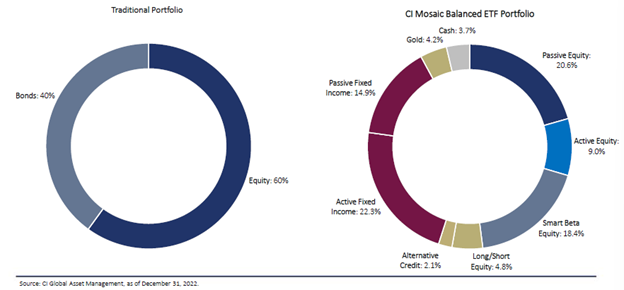

Make no mistake, CI Mosaic ETF Portfolios are not your usual "asset allocation" fund comprised of multiple underlying passive strategies. They offer true active management, with exposure to a suite of high-quality in-house and excellent third-party actively managed and smart beta ETFs.

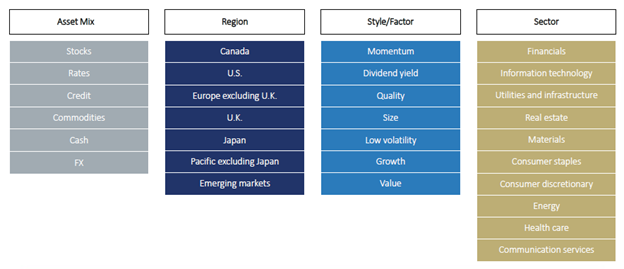

More importantly, CI Mosaic ETF Portfolios offer a granular approach to strategic asset allocation that goes beyond just stocks and bonds – the underlying ETFs actively seek out and capitalize on opportunities diversified among asset classes, factors, regions, sectors, and industries.

With just a single ticker, advisors can now replicate sophisticated portfolio strategies via a managed approach, allowing them to focus more on their client's needs and less on the minutiae of portfolio management and investment selection.

Mosaic ETF Portfolios

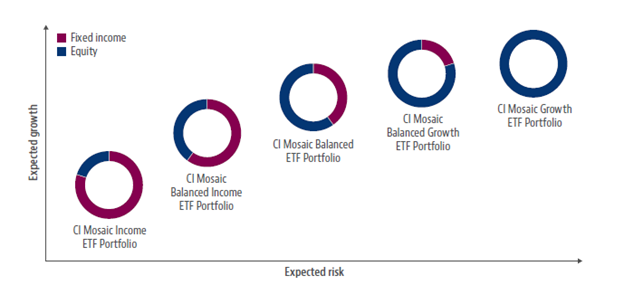

We offer five distinct Mosaic ETF Portfolios, with compositions suitable for investors of all investment objectives, time horizons, and risk tolerances. Our current lineup includes:

- CI Mosaic Income ETF Portfolio: A conservative 20/80 equity/fixed income allocation primarily focused on capital preservation while still ensuring a blend of income and growth.

- CI Mosaic Balanced Income ETF Portfolio: A 40/60 equity/fixed income allocation that balances income and long-term growth, with a tilt towards income.

- CI Mosaic Balanced ETF Portfolio: A traditional 60/40 equity/fixed income allocation that balances income and long-term growth.

- CI Mosaic Balanced Growth ETF Portfolio: A 80/20 equity/fixed income allocation that targets long-term growth while maintaining a meaningful allocation to lower-volatility fixed income.

- CI Mosaic Growth ETF Portfolio: An aggressive 100% equity portfolio that aims to maximize long-term growth potential.

The conditions of 2022 – rapidly rising rates and sticky inflation proved to be the downfall for many fund-of-funds solutions that relied solely on passive indexing strategies. As both stocks and bonds fell, even balanced funds suffered deep drawdowns that rattled investors.

In contrast, CI Mosaic Income ETF Portfolios have the flexibility to implement alternative strategies such as long-short equity, alternative credit, commodities exposure, and actively managed fixed-income. During turbulent market conditions, these strategies can enhance income, improve total return, provide downside protection, and lower correlations.

CI Mosaic ETF Portfolios are a prime example of our commitment to delivering value for advisors and their clients. Visit our Managed Solutions page to learn more about CI Mosaic ETF Portfolios and our broader suite of managed solutions.

About the Author

Stephen Lingard, Senior Vice President, Co-Head of Multi-Asset, brings first-hand global experience to his role as he has studied and worked in Europe, the US, and Asia over his 27+ year career. He joined CI GAM in 2019 as the multi-asset portfolio and research lead, with a macro, equity and alternative strategy focus. Prior to CI GAM, Stephen was Head of Multi-Asset Solutions with Franklin Templeton (Canada/Asia). Before that, he was an investment manager with Fidelity Investments (US & Canada), and prior to that, he was a Bond dealer at Société Générale Asia (Singapore). Stephen is a CFA charterholder with a BSc from Western University and holds an MBA from EU Business School. He is also a member of the Toronto CFA Society and spends his free time with North Toronto Soccer and Leaside Hockey.

IMPORTANT DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in exchange-traded funds (ETFs). You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on recognized Canadian exchanges. If the units are purchased or sold on these Canadian exchanges, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. Please read the prospectus before investing. Important information about an exchange-traded fund is contained in its prospectus. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated.

The opinions expressed in the communication are solely those of the author(s) and are not to be used or construed as investment advice or as an endorsement or recommendation of any entity or security discussed.

CI Mosaic ETF Portfolios are managed and advised by CI GAM |Multi-Asset Management, a division of CI Global Asset Management.

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what CI Global Asset Management and the portfolio manager believe to be reasonable assumptions, neither CI Global Asset Management nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.

CI Global Asset Management is a registered business name of CI Investments Inc.

©CI Investments Inc. 2023. All rights reserved.

Published February, 21, 2023