January 25, 2023

CCOM ETF reaches $100mm in AUM in less than three months. Here’s why.

Commodities, as investors have been reminded in the last two years, remain one of the few areas investors can find reliable inflation protection and real diversification. In December, Goldman put out one of its biggest calls saying, “Commodities will gain 43% in 2023 as supply shortages bite”.

Auspice Capital (subadvisor to the CI Auspice Broad Commodity ETF (CCOM)) is also very bullish, but notes that it won’t always be straight up, and there will be volatility along the way. Since 1970, the GSCI TR commodity index has actually outperformed most equity indices. The problem is that the volatility and drawdown are too high to just buy and hold.

For this reason, in 2010, Auspice launched the Auspice Broad Commodity Index, the underlying index CCOM tracks. The Auspice Broad Commodity Index is a rules-based index that attempts to capture upward trends while minimizing downside risk during downward trends in 12 diversified commodity futures contracts: soybeans, corn, wheat, cotton, sugar, crude oil, natural gas, gasoline, heating oil, copper, silver, and gold.

Individual commodity sub-sectors tend to perform dissimilarly in different market environments and significant drawdowns can be damaging to achieving long-term return objectives. A rules-based diversified broad commodity strategy like CCOM can alleviate these concerns. When you also consider the macro-environment landscape, the firm has never been so bullish on the commodity sector, and with $100mm in inflows in CCOM since its launch three months ago, investors seem to agree.

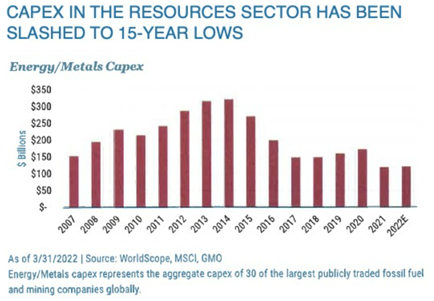

Capital expenditures

2022 data suggests that commodity CapEx and corresponding supply continue to be a problem that won’t be fixed quickly for the following reasons:

- Even though the world consumes 40% more of many major commodities than it did 15 years ago, resource companies have again slashed investment in new production as of late.

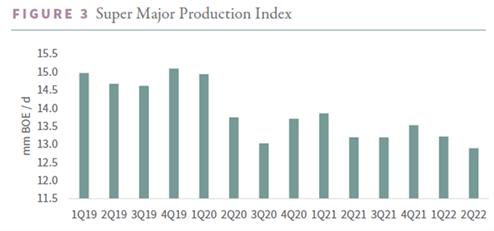

- Looking specifically at the energy supermajors, 2022 capital spending remains 30% below the 2019 level and 60% below the 2010-2016 average.

- Despite elevated prices, the supermajors’ production of oil and natural gas continues to fall.

Source: https://info.gorozen.com/2022-q2-commentary-why-resources-during-a-recession

In light of the deterioration in the fundamental backdrop JPMorgan, in their 2022 Annual Long Term Capital Market Assumptions, noted a “strong if not supercycle with a growing consensus around ESG considerations” and that CapEx starvation is likely to constrain commodity supply.

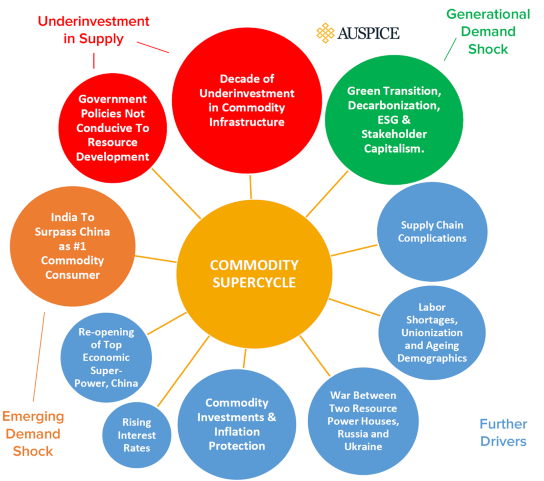

The commodity supercycle

Auspice also believes we are in the early stages of a commodity supercycle. Based on their research, “the two main ingredients for a commodity super cycle is an extended period of underinvestment in supply, and a generational demand shock. Today we have both.”

The image below summarizes the general drivers of the emerging commodity supercycle:

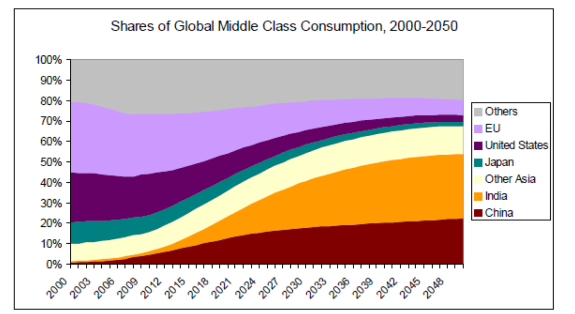

India on the incline

Auspice has been highlighting one thing to our clients lately that is largely being missed elsewhere: India is expected to have been the world's fastest growing economy in 2022. Poised to potentially create a similar demand shock to China 2000s boom.

- India's middle class is estimated to be 31% as of 2021, 41% by 2025, and projected to rise to 63% by 20471.

- The amount of commodities consumed by a country is a function of 2 factors: population and income - but not a straight line

- Rule of thumb - The demand shock occurs with the middle class when countries spend to industrialize/urbanize. There is disproportionate commodity demand between $4,000 and $20,000 GDP per capita:

- China hit $3,959 GDP per capita in 2001, currently $12556 (2021)

- India hit $2,277 in 2021, but the middle class is the key: $6,220+

- India currently has the 3rd largest middle-class after China and the US. Expected to be the largest by 20272

India’s emerging middle class will drive demand for the copper, iron ore, zinc, aluminum, and energy resources needed to supply the construction of modern infrastructure and cities, and power homes and industry.

1“One of every three Indians “middle class’; to double by 2047”

Source: "The Emerging Middle Class in Developing Countries"

"The middle classes of all countries have been the key drivers of the global economy in the last century. During the past several decades, world economic growth has occurred, mostly because of increased consumption in the middle classes of the United States, Europe, and other advanced countries." - Source: "The Middle Class in India: From 1947 to the Present and Beyond"

Reasons to invest in CI Auspice Broad Commodity ETF (CCOM)

We are bullish on commodities, and it seems investors are too. Within three months of launching, CCOM surpassed the $100mm in assets under management in late December. With the fall of stocks and bonds, investors are looking for a way to hedge against inflation. As a result, many are turning to commodities as historically their returns have been positively correlated with high inflation. While commodity investing can be volatile CCOM aims to replicate the Auspice Broad Commodity Index, which has a 10+ year track record of providing superior returns with lower volatility than major commodity indices.

Importantly, for investors and portfolio managers alike, those returns can be highly diversifying. Whereas energy and gold stocks have high correlations to equities, since October 2010 inception the Auspice Broad Commodity Index has just a 0.35 monthly correlation to the TSX60. For more information, visit CI Auspice Broad Commodity ETF.

Glossary of terms

Correlation: A statistical measure of how two securities move in relation to one another. Positive correlation indicates similar movements, up or down, while negative correlation indicates opposite movements (when one rises, the other falls).

Drawdown: Measures the peak-to-trough decline of an investment or, in other words, the difference between the highest and lowest price over a given timeframe.

Volatility: Measures how much the price of a security, derivative, or index fluctuates. The most commonly used measure of volatility when it comes to investment funds is standard deviation.

About the Author

Auspice Capital Advisors Ltd. is an innovative alternative asset manager that focuses on applying rules-based investment strategies across a broad range of financial and commodity markets. Auspice offers liquid alternative and commodity strategies that provide the benefits of active management and the efficiency of indexing. By being rules-based, Auspice offers products with greater transparency, liquidity, and cost effectiveness via multiple delivery mechanisms (Funds, Managed Accounts, ETFs, Indexes, and bespoke products).

Auspice works with a wide range of clients and develops solutions to improve their portfolio or product suite. Our strategies are available to institutions, financial professionals and high net worth individual investors as well as retail investors through the Auspice brand as well as sub-advisory and licensing arrangements.

IMPORTANT DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in exchange-traded funds (ETFs). You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on recognized Canadian exchanges. If the units are purchased or sold on these Canadian exchanges, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. Please read the prospectus before investing. Important information about an exchange-traded fund is contained in its prospectus. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated. Returns of the Index do not represent the ETF’s returns. An investor cannot invest directly in the Index. Performance of the ETF is expected to be lower than the performance of the Index.

The CI Auspice Broad Commodity ETF is an alternative mutual fund. It has the ability to invest in asset classes or use investment strategies that are not permitted for conventional mutual funds. The specific strategies that differentiate this fund from conventional mutual funds include: increased use of derivatives for hedging and non-hedging purposes; increased ability to sell securities short; and the ability to borrow cash to use for investment purposes. While these strategies will be used in accordance with the fund’s investment objectives and strategies, during certain market conditions they may accelerate the pace at which your investment decreases in value.

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.

Auspice Capital Advisors Ltd. are portfolio subadvisors to certain funds offered and managed by CI Global Asset Management.

CI Global Asset Management is a registered business name of CI Investments Inc.

©CI Investments Inc. 2023. All rights reserved.

Published January 23, 2023.