February 2, 2023

Expanding your Horizon: Looking Beyond U.S. Equity Markets

The period following the Great Financial Crisis has been a time of prosperity in North American equity markets. As a result, investors haven’t had many reasons to look for opportunities globally. But the equities landscape appears to be changing.

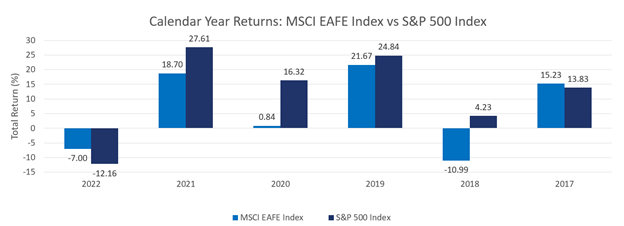

In 2022, international developed equity markets (MSCI EAFE Index) outperformed the U.S. equity markets for the first time since 2017. Given global interest rates, growth outlooks and valuations for different equity markets, international equities now present many attractive investment opportunities.

In this article, we discuss why investors shouldn’t overlook global equities. We also explore some attractive opportunities that exist outside of North America.

Source: Morningstar Research Inc., as of December 31, 2022. All returns in Base Currency.

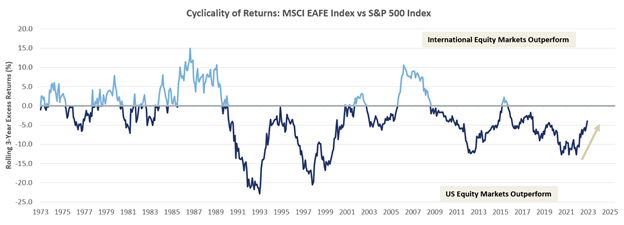

International vs. U.S. markets – A story of cyclicality

The relationship between international and U.S. markets tends to be cyclical. While U.S. equities have dominated international equities over the past decade, between 2000 and 2010, international markets delivered better returns than their U.S. counterparts amidst two market recessions.

Source: Morningstar Research Inc., as of December 31, 2022. All returns in Base Currency.

While a recession has not yet hit the U.S., various headwinds from the inverted yield curve, higher rates, U.S. dollar outlook, and labour market will make 2023 a challenging year for the U.S. equity markets. However, these challenges could prove to be opportunistic for other markets as we have already started to see some mean reversion over the past year. Given these conditions, international and emerging market equity ETFs may provide an outlet for future growth.

Investors interested in gaining international or emerging market exposure can check out our selection of ETFs, for both broad international and emerging markets.

Broad International

Ticker | Name | Overview | Mgt Fee |

CI WisdomTree International Quality Dividend Growth Index ETF | Provides exposure to dividend paying companies in the developed world (excluding Canada and the U.S.) with strong quality growth characteristics. | 0.48% |

Emerging Markets

Ticker | Name | Overview | Mgt Fee |

CI ICBCCS S&P China 500 Index ETF | Provides exposure to 500 of the largest, most liquid Chinese companies while approximating the sector composition of the broader Chinese equity market. | 0.55% | |

CI WisdomTree Emerging Markets Dividend Index ETF | Provide exposure to targeted emerging market dividend paying companies. | 0.38% | |

CI Emerging Markets Alpha ETF | Provides exposure to companies that the portfolio advisor believes have good growth potential, located in emerging markets or serving customers in emerging markets. | 0.85% |

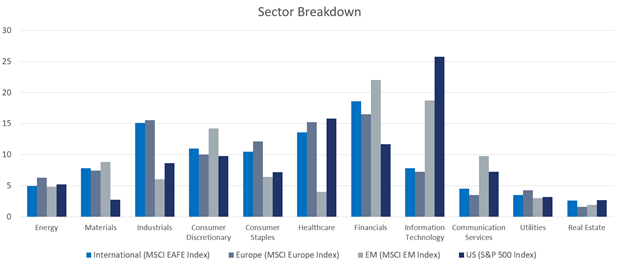

Sector leadership in international markets

Large U.S. tech stocks helped fuel the exceptional run-up in the U.S. equity market after the Global Financial Crisis. However, this also led to portfolios being overweighted and reliant on a sector that is sensitive to the higher interest rates we are currently experiencing. For context, the weight of the technology sector within the S&P 500 Index on December 31st, 2007, was 13.9%. As of December 31, 2022, it’s 25.7% after peaking at 30% in November 2021.

In comparison, international and emerging equity markets (Europe in particular), tend to have a higher allocation to value sectors including energy, materials, and industrials, which have historically performed better as rates rise. As of December 31, 2022, MSCI EAFE Index had a 7.8% weight in the technology sector and an 18.6% weight in the financial sector. Investors interested in gaining exposure to broad Eurozone equity can check out CI Wisdom Tree Europe Hedged Equity Index ETF:

Europe

Ticker | Name | Overview | Mgt Fee |

CI WisdomTree Europe Hedged Equity Index ETF | Provide exposure to broad Eurozone equity from dividend paying companies with an exporter tilt | 0.55% |

Source: Morningstar Research Inc., as of December 31, 2022. All returns in Base Currency.

Attractive entry points

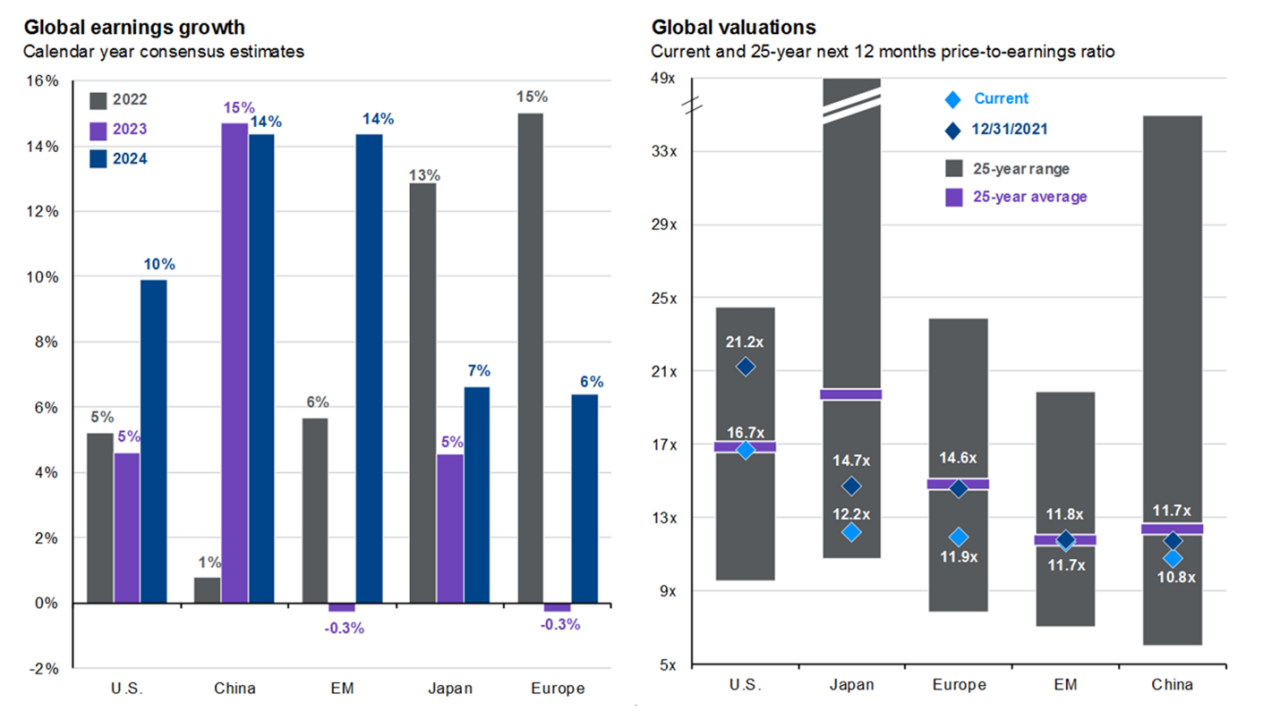

It would be foolish to say international markets are immune from the same challenges faced by the U.S. But given the factor regime shift we have witnessed, from growth to value, coupled with more attractive valuations, international markets seem enticing once again.

Source: FactSet, MSCI, Standard & Poor’s, Thomson Reuters, J.P. Morgan Asset Management. Data are as of December 31, 2022.

Various international markets (developed and emerging) currently trade at attractive valuations relative to the U.S., and near the bottom of its historical 25-year range. Valuation expansion will likely be a more significant tailwind for international market returns than U.S. market returns going forward.

Diversify with international equities

Post-Global Financial Crisis, U.S. equity outperformance was underpinned by a decade of low rates and strong earnings momentum, but this tide seems to be reversing. While U.S. markets look expensive relative to bonds, stocks in other markets around the globe look a lot more attractive.

It’s impossible to predict what the next decade will look like for international and U.S. markets. But the importance of diversification, cyclicality of performance and attractive valuations make international equities an appealing asset class once again. Visit our ETF solutions page to learn more about our selection of ETFs focused on various International Markets.

GLOSSARY OF TERMS:

Alpha: A measure of performance often considered the active return on an investment. It gauges the performance of an investment against a market index or benchmark which is considered to represent the market’s movement as a whole. The excess return of an investment relative to the return of a benchmark index is the investment’s alpha.

About the Author

Nirujan Kanagasingam is SVP, Head of Investment Advisory and ETF Strategy at CI Global Asset Management. In this role, he oversees three core functions: the Institutional Portfolio Management team, ETF Strategy, and Investment Portfolio Advisory.

Nirujan is responsible for advancing the growth of CI’s investment platform by partnering closely with the distribution team, as well as retail and institutional clients, to deliver portfolio insights and product expertise. Previously, Nirujan led the firm’s ETF business, where he played a key role in product management, indexing, factor research, ETF portfolio development, and the launch of numerous ETFs in the Canadian marketplace.

Nirujan holds a Bachelor of Commerce in Finance and Accounting from Ryerson University and is a CFA Charterholder.

IMPORTANT DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in exchange-traded funds (ETFs). You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on recognized Canadian exchanges. If the units are purchased or sold on these Canadian exchanges, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. Please read the prospectus before investing. Important information about an exchange-traded fund is contained in its prospectus. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated. Returns of the Index do not represent the ETF’s returns. An investor cannot invest directly in the Index. Performance of the ETF is expected to be lower than the performance of the Index.

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

CI Global Asset Management is licensed by WisdomTree Investments, Inc. to use certain WisdomTree indexes (the “WisdomTree Indexes”) and WisdomTree marks.

“WisdomTree®” and “Variably Hedged®” are registered trademarks of WisdomTree Investments, Inc. and WisdomTree Investments, Inc. has patent applications pending on the methodology and operation of its indexes. The ETFs referring to such indexes (the “WT Licensee Products”) are not sponsored, endorsed, sold, or promoted by WisdomTree Investments, Inc., or its affiliates ("WisdomTree"). WisdomTree makes no representation or warranty, express or implied, and shall have no liability regarding the advisability, legality (including the accuracy or adequacy of descriptions and disclosures relating to the WT Licensee Products) or suitability of investing in or purchasing securities or other financial instruments or products generally, or of the WT Licensee Products in particular (including, without limitation, the failure of the WT Licensee Products to achieve their investment objectives) or regarding use of such indexes or any data included therein.

ICBC Credit Suisse Asset Management (International) Company Limited, is a portfolio sub-advisors to certain funds offered and managed by CI Global Asset Management.

CI Global Asset Management is a registered business name of CI Investments Inc.

©CI Investments Inc. 2023. All rights reserved.