| 2021-06-07 |

What the Disability Tax Credit can mean for eligible Canadians and their families

Federal budget 2021, released April 19, 2021, proposes to expand eligibility for the disability tax credit in the areas of mental functions and life-sustaining therapy. This is welcome news for thousands of Canadians who did not previously qualify for the credit. Not only does eligibility for the disability tax credit offer immediate tax savings, but it opens the door to other tax benefits and programs to assist eligible Canadians with disabilities.

WHAT IS THE DISABILITY TAX CREDIT (DTC)?

The DTC is a non-refundable tax credit intended to reduce income tax payable for eligible persons with a disability and/ or their support persons. It is comprised of the Disability Amount (‘base amount’) for eligible individuals of any age and the Supplement for Children with Disabilities (‘supplemental amount’) for eligible children who are under 18 at the end of the tax year. Both amounts are indexed annually and have a provincial counterpart to the federal amount. The federal portion is the same for every eligible Canadian, while the provincial/territorial amounts vary by jurisdiction. The DTC can be claimed by the eligible individual, persons supporting the eligible individual, or a combination thereof.

Where an eligible individual qualifies for the DTC for a particular year, those claiming the credit can request their income tax returns be adjusted as far back as 10 years to claim the DTC.

HOW IS THE DTC CALCULATED?

Each government allows taxpayers to reduce their taxes payable by a percentage of their non-refundable tax credits. The federal government rate is 15%. The federal DTC is calculated by multiplying by the base amount by 15%. In certain situations, the supplemental amount may be reduced. Where there is no reduction to the supplemental amount for the tax year, the maximum tax credit available in respect of the supplemental amount is also 15% of the supplement. For more information on how the DTC is calculated, please see the CRA Disability Tax Credit Folio.

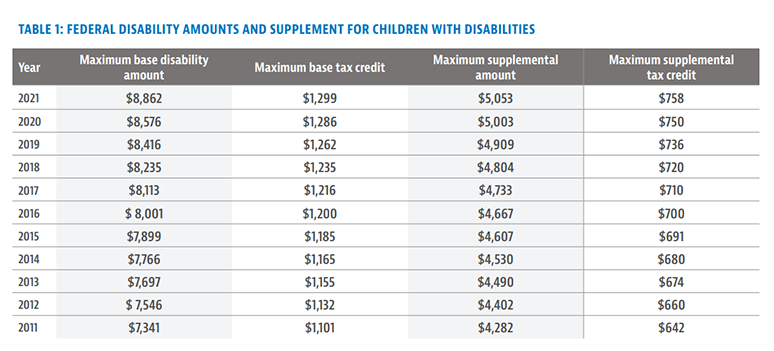

Table 1 shows that for 2021 the federal base tax credit is $1,299 and the maximum federal supplement credit is $758 for a total federal tax savings of $2,057.

HOW DO YOU APPLY FOR THE DTC?

CRA Form T2201 Disability Tax Credit Certificate must be completed by a medical practitioner to certify that the individual has a severe and prolonged impairment. The completed T2201 is then submitted to the CRA who will assess qualification for the DTC based on the form. Please see Eligibility for the Disability Tax Credit for more details about eligibility and how to complete Form T2201. In completing the form, ask your medical practitioner to indicate the earliest start of the condition so the DTC may be claimed for prior years where applicable.

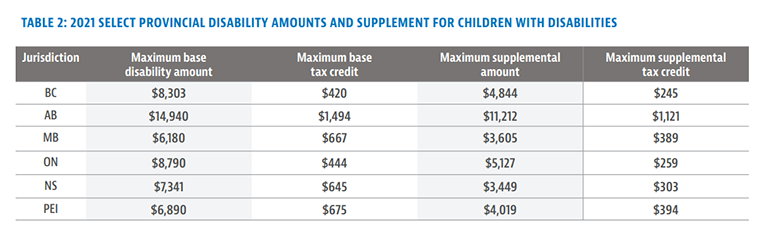

The provincial and territorial amounts are in addition to the federal credit. They are calculated in the same manner as the federal credit, but the credit amounts and applicable tax rates vary by jurisdiction. For example, Table 2 below shows that Alberta’s provincial base credit offers additional $1,494 in tax savings plus $1,121 where the maximum supplement is available. For 2021, this means that for a family in Alberta with a child under age 18 who qualifies for the disability tax credit, the combined federal and provincial tax savings from the disability tax credit and supplements can be as high as $4,672.

OTHER BENEFITS AND PLANNING TOOLS

In addition to the disability tax credits discussed above, qualification for the DTC is a gateway to accessing other tax benefits, credits, deductions, and planning tools:

Child Disability Benefit (CDB) – Tax free monthly payment for parents of a child under 18 who qualifies for the DTC and who also qualifies for the Canada Child Benefit (CCB). The CDB is calculated annually based on prior year Adjusted Family Net Income and begins to reduce.

When AFNI exceeds $68,708. Where your child qualifies for the DTC you will automatically receive the CDB based on your prior year AFNI.

Claims for certain Medical Expenses – claims for attendant care or care in a nursing home require the individual who requires care qualify for the DTC.

The Canada Caregiver Credit is a non-refundable tax credit available to Canadians who support a spouse or commonlaw partner, or other dependent with a physical or mental impairment. Where the dependent qualifies for the DTC, a letter from a medical practitioner evidencing the condition is not required.

Disability Supports Deduction – A deduction from income for eligible expenses paid to work, carry on a business, or go to school. Unlike the disability tax credit and the medical expense tax credit where certain support people may claim the tax credit, the disability supports deduction may only be claimed by the eligible individual and not by any persons supporting them.

Registered Disability Savings Plan (RDSP) – A tax-deferred savings plan designed to help families save for a beneficiary who is eligible for the DTC. RDSP contributions are not tax deductible and can be made until the end of the year in which the beneficiary turns 59. Contributions that are withdrawn are not included as income to the beneficiary when they are paid out of an RDSP. However, Canada Disability Savings Grants and Bonds, RDSP income and gains, and rollover proceeds are included in the beneficiary’s income for tax purposes when paid out of the plan.

The Qualified Disability Trust (QDT) was created in 2016 as part of the changes to taxation for testamentary trusts (trusts set up by a Will) and requires the qualifying beneficiary to be eligible for the DTC. The QDT is an exception to new rules that all testamentary trusts are taxed at top marginal rates. A QDT has access to the graduated tax rates that previously applied to all testamentary trusts.

Preferred Beneficiary Election (PBE) – The PBE is available to certain trusts with one or more qualifying beneficiary who is/ are eligible for the DTC. Where a PBE is jointly made by the trustee and the beneficiary, then the income of the trust may be taxed in the hands of the preferred beneficiary but may continue to accumulate inside the trust.

CONCLUSION

Qualification for the disability tax credit is a critical tax saving opportunity for recipients and their families. The suite of planning tools that also become available where someone qualifies for the DTC is an opportunity for advisors to discuss with their clients what might be suitable for their circumstances, including the decision to claim the DTC for earlier tax years. Requesting the CRA adjust prior year tax returns to claim the DTC further exposes those tax years to possible audit. Ensure you are comfortable with your filing position on all matters in respect of those prior tax years.

1 A non-refundable tax credit can only be used to reduce federal or provincial/territorial taxes payable to zero. In general, they cannot be carried over to future years

2 This list is not exhaustive and does not cover additional provincial programs and benefits also available

3 For the payment period July 2020 to June 2021, the maximum CDB is $240.50 per month. Payments begin to reduce where AFNI for 2019 exceeds $68,708.

4 The lifetime maximum contribution amount to an RDSP for a particular beneficiary is $200,000

IMPORTANT DISCLAIMERS

This communication is published by CI Global Asset Management (“CI GAM”). Any commentaries and information contained in this communication are provided as a general source of information and should not be considered personal investment advice. Facts and data provided by CI GAM and other sources are believed to be reliable as at the date of publication. Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI GAM has taken reasonable steps to ensure their accuracy.

Market conditions may change which may impact the information contained in this document. Information in this communication is not intended to provide legal, accounting, investment or tax advice, and should not be relied upon in that regard. Professional advisors should be consulted prior to acting on the basis of the information contained in this communication.

You may not modify, copy, reproduce, publish, upload, post, transmit, distribute, or commercially exploit in any way any content included in this communication. You may download this communication for your activities as a financial advisor provided you keep intact all copyright and other proprietary notices. Unauthorized downloading, re-transmission, storage in any medium, copying, redistribution, or republication for any purpose is strictly prohibited without the written permission of CI GAM.

CI Global Asset Management is a registered business name of CI Investments Inc.

©CI Investments Inc. 2021. All rights reserved.

Published June 1, 2021