January 27, 2023

2023 Outlook – Fixed Income

As market participants usher in a new calendar year, there is an undeniable sense of expectation, by many, of better outcomes across assets in 2023. How realistic is this optimism?

The answer to this question starts and ends with one variable: inflation.

It is clear that the “bear” of inflation has ended a decades-long hibernation as result of policies designed to offset the economic damage from the pandemic. And this “bear” is not well understood by current policy makers and investors alike whose analytical skills on this topic have been dulled by so many years of obsolescence.

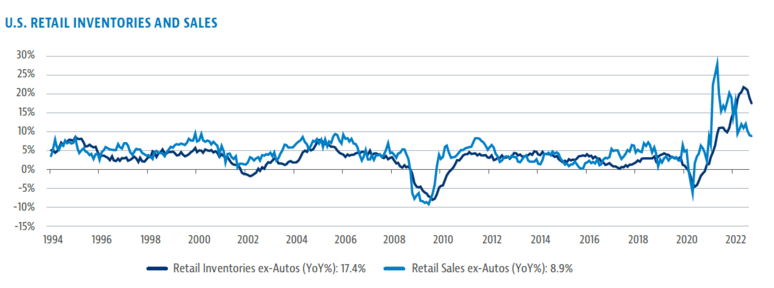

Here is how we are expecting the inflation story to unfold. Excess retail inventories (ex-autos) of goods are staggeringly high. Demand is waning as a result of consumption that was brought forward during the pandemic, the lagged impact of tighter financial conditions and the higher cost of non-discretionary components of one’s budget. This will continue to exert downward pressure on goods pricing. However, the pricing of services in the economy are more labour intensive and we are discovering these can be much stickier. This is especially true when the labour market is tight with low unemployment and high job vacancies. A final piece of the inflation puzzle has been the strength in rents. We expect these should moderate as decade highs in mortgage rates continue to reduce owners imputed rents from sales activity.

Source: Bloomberg Finance L.P., as of October 31, 2022.

We expect a further decline to headline inflation to 4%-5% year-over-year by mid-2023, but then the hard work begins. We believe a surge in labour supply is unlikely, so avoiding a wage spiral higher will require a reduction in demand for labour. This will very likely lead to a recession whose severity and duration we forecast to be moderate, but not insignificant.

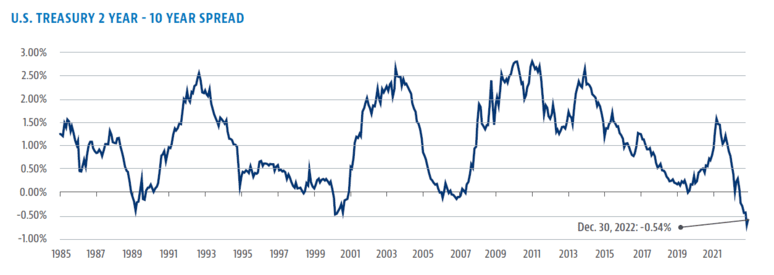

This scenario leaves us with both the U.S. Federal Reserve and Bank of Canada ending their respective hiking cycles in the first quarter of 2023 and, crucially, staying at their terminal rates for the remainder of the year. Yields on government bonds will be range bound with an upward tilt until recessionary data arrive. We forecast that we have likely witnessed the maximum yield curve inversion as measured by 2 year-10 year spread in both countries, but a normalization of the curve will be dependent upon the close proximity to cuts by the central banks.

Source: Bloomberg Finance L.P., as of December 30, 2022.

This chart shows the difference between the U.S. Treasury 10-year yield and 2-year yield. Values in H2 2022 represent the lowest levels since 1985.

Our view on both investment grade credit and high yield credit is medium term positive. The foundation for this view stems from a mostly supportive technical backdrop: supply and demand are in rough equilibrium, current yields are an attractive entry point, and our expectation for reduced interest rate volatility. Offsetting these points is a deteriorating fundamental picture as reduced economic activity will decrease free cash flow generation and begin to weaken credit metrics. This results in a credit strategy that will be opportunistic in adding exposure but will be looking to take profits during bouts of exuberance. We continue to see good opportunities in emerging market sovereign bonds, specifically those positively exposed to energy and a weakening U.S. dollar (USD. While we are not expecting a collapse in the USD as 2023 unfolds, the drivers of previous strength will gradually shift in favour of the Euro with the European Central Bank (ECB) needing to play catch up on rate hikes.

About the Author

The Investment Advisory team is a specialized group within CI Global Asset Management, organized by asset class coverage and focused on providing product expertise and strategic guidance across CI GAM’s advised and sub advised strategies. The team works closely with Portfolio Management, the Distribution team, and institutional partners to refine product positioning and deliver actionable, competitive insights for advisors and investors. With deep expertise in investment strategy, the team supports the continued growth of CI GAM’s investment solutions.

IMPORTANT DISCLAIMERS

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication.Market conditions may change which may impact the information contained in this document. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

The opinions expressed in the communication are solely those of the authors and are not to be used or construed as investment advice or as an endorsement or recommendation of any entity or security discussed.

Certain statements in this document are forwardlooking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions.

Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what CI Global Asset Management and the portfolio manager believe to be reasonable assumptions, neither CI Global Asset Management nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

The author and/or a member of their immediate family may hold specific holdings/securities discussed in this document. Any opinion or information provided are solely those of the author and does not constitute investment advice or an endorsement or recommendation of any entity or security discussed or provided by CI Global Asset Management.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.