January 27, 2023

2023 Outlook – Real Assets

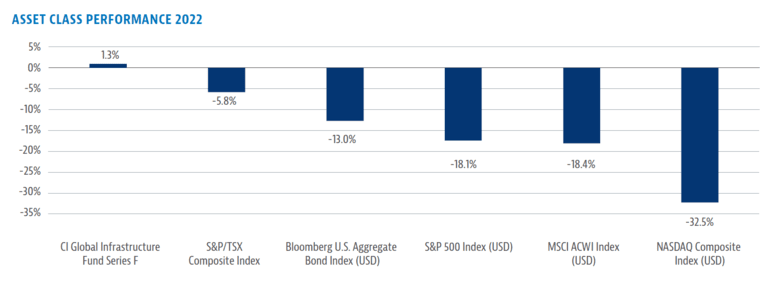

2022 has left the two real assets segments – infrastructure and real estate – with interesting backdrops for 2023. While both asset classes had good operating performance and are likely to see inflows from institutional and retail investors, real estate enters 2023 after a challenging year where valuations weakened substantially, while infrastructure substantially outperformed broader equity and bond markets. In summary, real estate offers compelling valuations and rebound opportunity, while infrastructure continues to offer a compelling track record of performance through various market cycles.

Infrastructure outlook

With our global infrastructure strategies recording positive to flat returns for 2022, in contrast to most global equity and bond indices, infrastructure has again shown itself to be a resilient asset class, providing a return profile independent of traditional bond and equity markets.

CI GAM, Morningstar Research Inc., as of December 30, 2022.

On a forward-looking basis, we still like infrastructure for its stability, returns, and inflation protection. While many commentators see deterioration in economically sensitive companies’ 2023 earnings due to economic softening, the steady and defensive characteristics of infrastructure firms’ earnings and operations will continue to be on display in 2023. In times of greater uncertainty, boring companies are exciting opportunities. Within infrastructure, embedded inflation protection will provide an uplift to revenues. Expected earnings upgrades, which remain reasonably priced, are in line with its historical premium to broader equity markets at approximately 2x higher P/E than the S&P 500.

Sectoral breakout

Source: Bloomberg Finance L.P., as of December 30, 2022.

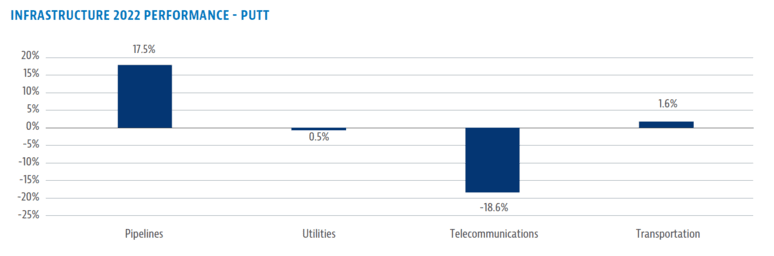

While it is appropriate to think of infrastructure as an asset class, when we look at its subsectors there was a clear differentiation among energy, utilities, telecommunication, and transportation. Aided by the re-opening and the Russian invasion of Ukraine, energy was the top performer, while the “growthier” companies engaged in data infrastructure suffered from reduced valuations. Utilities and transportation offered broadly stable returns. While we think that the performance differential between these two sectors will not be as wide next year, we continue to see the rationale for being overweight energy as valuation remains undemanding and global players seek stable supply from North American energy production.

However, we think that the telecommunications infrastructure companies will be better performers in 2023 as interest rates (likely) stabilize valuation pressure and ongoing growth in data consumption delivers higher earnings and cash flows.

Transportation remains an interesting opportunity, given the ongoing re-opening opportunity (particularly with China adjusting its COVID policies) versus the potential for economic weakness inhibiting travel. We remain overweight toll roads, many of which have recovered to 2019 traffic levels with higher tolls from inflation passthroughs, and underweight European airports which face a variety of regulatory and economic challenges.

Additionally, the opportunity within utilities continues to be growth within renewables, although higher energy prices have produced idiosyncratic regulatory pressures via price caps on tariff passthroughs to utility consumers. We are constructive on this sector, but moderately underweight given better opportunities in other sectors. For investors focused on energy transition opportunities, while our broader infrastructure funds are engaged on this theme, we continue to recommend the CI Global Sustainable Infrastructure Pool (CGRN), which focuses on this theme and recorded a 1.1% return from its inception at the end of September, proving that these assets need not compromise on returns.

Given reasonable valuation, stable competitive environments and returns, as well as inflation protection embedded within the operating and regulatory models, we expect infrastructure allocations to meet or exceed most investors’ goals through 2023.

Real estate outlook

2022 was a challenging year for real estate related equities as sharply higher interest rates, which resulted from elevated inflation levels, weighed on valuations. Most major REIT indexes were down 20-25%, underperforming broader equity markets.

The outlook for 2023 is perhaps a bit cloudier than normal with central banks trying to thread the needle between bringing inflation down without tipping the economy into recession. From a real estate perspective, we have a generally positive outlook based on discounted valuations to net asset value, bond yields which have likely seen their peak, strong balance sheets, and fundamentals that should remain resilient even in a weaker economy.

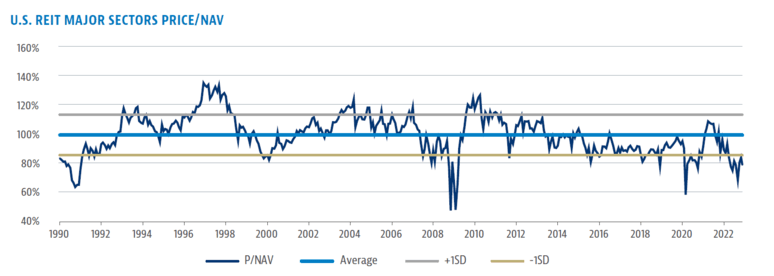

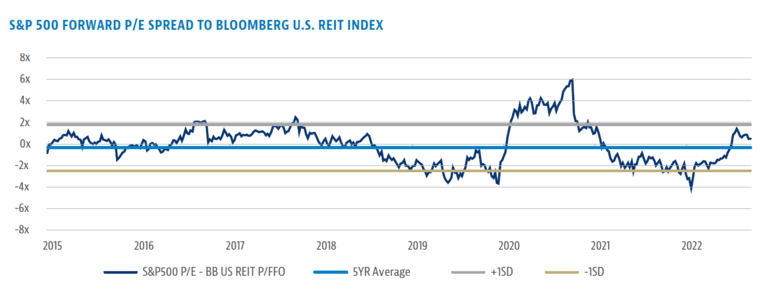

Real estate looks attractively valued on an absolute basis, as well as a relative basis to broader equity markets. On an absolute basis, U.S. REITs are trading 15-20% below net asset value (compared with a long-term average around parity), which has historically represented a good time to buy the sector. On a relative basis, the broader market as measured by the S&P 500 has historically traded at a modest earnings multiple discount to real estate, whereas it is currently trading at a premium to REIT valuations.

Source: Bloomberg Finance L.P., as of December 20, 2022.

Source: Bloomberg, S&P Capital IQ, Green Street Advisors and CI Global Asset Management as of December 2022.

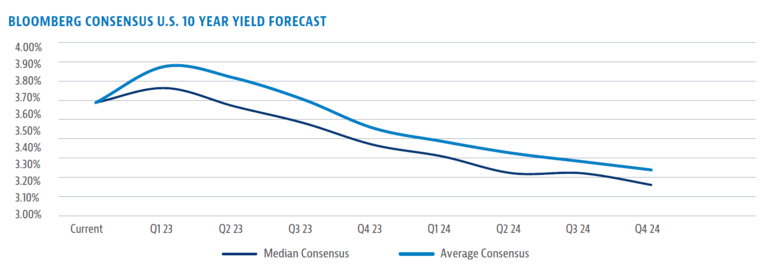

Central banks have been extremely aggressive raising interest rates in 2022, with administered rates going from essentially zero to over 4% in the U.S. and Canada through a series of oversized hikes. While one or two further increases are possible, it seems that the end of this hiking cycle is near. As a result, longer term bond yields, which are the ones most impactful for real estate valuations, have likely peaked. Indeed, economists are forecasting that U.S. 10 Year yields may steadily decline over the next couple years.

Source Bloomberg Finance L.P. as of December 21, 2022.

Over the past several years REITs have focused on bringing down debt levels as well as distribution payout ratios, which should put companies on better footing if we are entering a period of potential economic weakness. Several real estate sub-sectors (perhaps with office being a notable exception) are entering a potential downturn with low vacancy rates and strong market rent growth, which could cause real estate operating cash flows to be more durable than one would ordinarily assume. Most of our real estate exposure is focused on the industrial, residential, and necessity-based retail sectors. The industrial sector will continue to benefit from market rents which are significantly higher than in place rents, as well as strong demand from ecommerce, supply chain optimization and higher inventory levels. Residential rental housing demand should persist as rising interest rates have made purchasing a home more expensive, and strong immigration in markets like Canada, offer another tailwind. Grocery anchored retail has proven to be operationally resilient through the pandemic, and many neighborhood shopping centres are increasingly being integrated into retailer omnichannel fulfillment strategies.

While 2023 will likely be a challenging year for the broader economy, we believe it may be tougher in the private vs. public real estate market, as the latter has seen significant valuation declines for their portfolios whereas the former is lagging. A stabilization in the interest rate environment next year may reveal that current public market real estate valuations have overshot on the downside.

About the Author

Kevin McSweeney is Senior Vice-President, Portfolio Manager & Lead – Canadian Equities with CI Global Asset Management. He began his professional financial services career in 2000 as a Financial Economist with Finance Canada. Following this he spent time at Scotiabank, including time in Corporate Credit Risk Management. He has been with CI Investments in a variety of progressively senior roles since August 2008. Kevin began at CI with the high yield bond team as an investment analyst, progressing to portfolio manager. In 2016, he joined the equity team as an infrastructure and real estate specialist portfolio manager. He currently manages or co-manages multibillion-dollar asset pools in a variety of strategies including balanced, income and dividends, infrastructure and real assets, and Canadian and global equities. He was named as lead of Canadian equities for CI GAM in 2022.

A native of Halifax, Kevin has a BA from St. Mary’s University, an MBA from Dalhousie University and a variety of professional designations, including Futures and Options licensing and the Chartered Financial Analyst designation.

About the Author

Lee is a portfolio manager with a successful long-term track record of managing real estate assets. He joined CI Global Asset Management in 2018 following 12 years as a lead manager at the former First Asset Investment Management Inc. Lee holds a Bachelor of Science (Statistics) degree from the University of Western Ontario and a Master of Business Administration (Finance) degree from York University. He also holds the Chartered Financial Analyst (CFA) designation.

IMPORTANT DISCLAIMERS

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication.Market conditions may change which may impact the information contained in this document. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

The opinions expressed in the communication are solely those of the authors and are not to be used or construed as investment advice or as an endorsement or recommendation of any entity or security discussed.

Certain statements in this document are forwardlooking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions.

Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what CI Global Asset Management and the portfolio manager believe to be reasonable assumptions, neither CI Global Asset Management nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

The author and/or a member of their immediate family may hold specific holdings/securities discussed in this document. Any opinion or information provided are solely those of the author and does not constitute investment advice or an endorsement or recommendation of any entity or security discussed or provided by CI Global Asset Management.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.