May 2, 2022

Inflation Is Not the Only Challenge

Statistics Canada reported higher inflation in February 2022. The Consumer Price Index rose 5.7% compared to a year ago as of February 2022. Commodity prices have skyrocketed as a result of the current Russia-Ukraine conflict. The two countries are major exporters of commodities such as oil, aluminum, nickel, copper and wheat. They respectively account for 17%, 10%, 22%, 9% and 26% of the global supply. The markets have been aggressively repricing these commodities as shown in the table below. Supply is unlikely to be restored anytime soon as Ukraine is being attacked and Russia sanctioned. The bad news is these commodities are consumed directly or indirectly in our everyday life; the price hikes are effectively impacting everyone. Employees have enjoyed wage growth in 2021 and will likely again in 2022. December’s Labour Force Survey, as conducted by Statistics Canada, indicated that average wages gained 2.7% over 2021. However, they were not enough to offset inflation. What has helped consumers to overcome inflation were their “COVID-19” savings and low borrowing costs. As inflation continues to rise while savings are depleted and borrowing costs increase, consumer resilience to inflation will be tested in the coming months.

Commodity | Year-to-date change in price (USD)* |

Oil (WTI Crude) | 38% |

Aluminum (LME Aluminum) | 23% |

Nickel (LME Nickel) | 60% |

Copper (LME Copper) | 8% |

Wheat (CBT SRW Wheat) | 36% |

Source: Bloomberg Finance L.P.*As at April 5, 2022.

Obviously, everyone’s consumption basket is different. However, it is fair to assume that most of us will be paying over 5% more for food, utilities and gasoline this year – and that’s if you don’t buy a new car, new clothing or electronics. Compared to going through a war in your country, these additional costs are more than tolerable. We expect inflation to moderate to more normal levels in 2023. Central banks, including Bank of Canada, are raising interest rates. While it adds a burden to consumers and borrowers, it should also cool consumption. Expectations have been aggressive; the markets were expecting four rate hikes of 25 basis points just a few months ago and now as much as 200 basis points. In addition, commodity prices are effectively future prices and already reflect the supply challenges expected in the months to come.

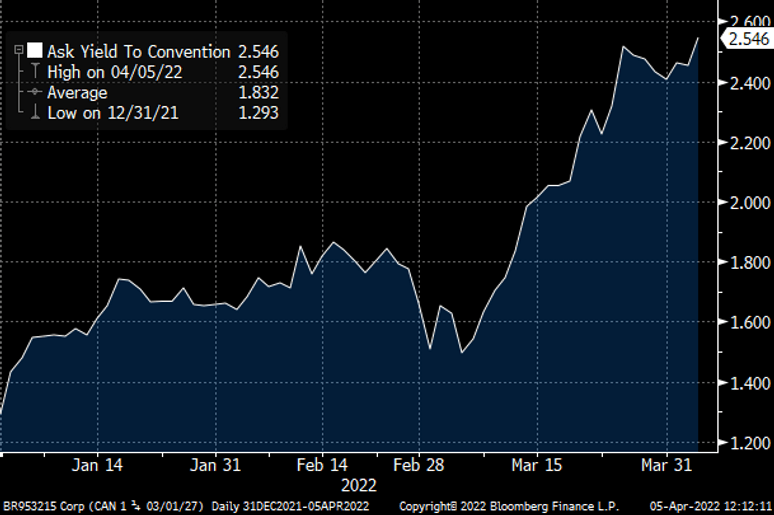

So how do inflation, higher interest rates and potentially cooling consumption affect the investment landscape and our portfolio positioning? We have had some strong markets in the last few years and built up solid gains for investors. We have warned of the likelihood and implications of high inflation and the challenges of investing in fixed income. Canadian equity, as represented by the S&P/TSX Composite Index, performed positively on a year-to-date basis. Our U.S. counterpart, the S&P 500 Index, was 4% lower. With war in the Ukraine and higher interest rates, stock markets have been surprisingly resilient. Our exposure to energy has generated good results this year and helped to offset some of the negativity in the overall market. Higher interest rates have done more damage to fixed-income investments. Even though Bank of Canada has only hiked rates once so far, fixed-income markets have already been repriced to future prices, which include the rate hikes that are coming. The chart below shows the yields of 5-year Government of Canada bond. The markets were expecting the coming 5-year rates to average 1.29% back in December 2021. This compares to as high as 2.55% on April 5, 2022. It is important to note that rates and prices have an inverse relationship, meaning bond prices have been significantly lower during this period. The FTSE TMX Universe Bond Index has lost over 7% thus far in 2022, hence underperforming equity. We have been calling for this correction and thus significantly underweight government bonds in our portfolios since the fourth quarter of 2020.

Source: Bloomberg Finance, LP

As fixed income gets repriced aggressively, we have turned less bearish. We expect inflation to moderate in 2023 and central banks to be less aggressive than the markets currently expect. Rate hikes will no doubt be cooling consumption and economic growth, along with inflation. Central banks will need to be sensitive and not take rates too far. As such, we are buying fixed income gradually to narrow our underweight position. At the same time, we are trimming equity as we anticipate weaker economic growth to affect corporate earnings. Some countries and sectors will fare better. We remain bullish and continue to increase holdings in certain countries (Canada and emerging markets) and sectors (energy, materials, financials, semiconductors). Overall, our portfolios will be more balanced with higher convictions going into the next 12 months as we anticipate new challenges and opportunities.

About the Author

Alfred Lam, Senior Vice President, Co-Head of Multi-Asset, joined CI GAM in 2004. He brings over 23 years of industry experience to his portfolio design, asset allocation, portfolio construction, and risk management responsibilities, which include chairing the multi-asset investment management committee and sizing investment bets to drive added value and manage risk. Alfred holds the CFA designation and an MBA from York University Schulich School of Business.

IMPORTANT DISCLAIMERS

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

The opinions expressed in the communication are solely those of the author(s) and are not to be used or construed as investment advice or as an endorsement or recommendation of any entity or security discussed.

The author and/or a member of their immediate family may hold specific holdings/securities discussed in this document. Any opinion or information provided are solely those of the author and does not constitute investment advice or an endorsement or recommendation of any entity or security discussed or provided by CI Global Asset Management.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what CI Global Asset Management and the portfolio manager believe to be reasonable assumptions, neither CI Global Asset Management nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.

CI Global Asset Management is a registered business name of CI Investments Inc.

©CI Investments Inc. 2022. All rights reserved.

Published May 2, 2022