September 26, 2022

The Benefits of Covered Call ETFs

A combination of high inflation and numerous policy interest rate hikes from the Bank of Canada created strong headwinds for equity and fixed-income assets alike, with both suffering drawdowns.

Investors looking to adapt to the current macroeconomic environment should consider the benefits of options writing strategies – in particular, using ETFs that implement a covered call overlay.

Covered call ETFs can help mitigate downside volatility in client portfolios, enhance income yield, and still allow decent participation in upside returns.

Covered call use cases

Current market conditions have reduced the viability of traditional income-generating assets like REITs, corporate bonds, preferred shares, and dividend stocks. Using covered calls instead can help investors better target a desired risk/return profile for their portfolio.

Investors in the withdrawal phase can use covered calls to potentially enhance yield. The premium received can be used for income instead of having to sell shares. Selling covered calls when volatility trends high can significantly increase premiums, leading to greater income potential.

Investors concerned about preservation of capital but unwilling to pay for a hedge or go to cash can use covered calls to provide a degree of downside protection without having to give up gains completely. Finally, options premiums are taxed favourably as capital gains, making covered calls highly tax efficient.

Why use a covered call ETF

While investors can manually write calls on their underlying stock holdings, this approach can be costly and time consuming for those not familiar with the use of derivatives.

Option volatility, time to expiry and moneyness of option should all be taken into consideration when determining the optimal strike price and expiry date. If a call goes in-the-money, investors must decide whether to wait until expiry, roll the expiry date out further, or roll the strike price up higher.

An easier, hands-off solution is using an ETF that implements a covered call overlay. In this case, the fund manager is responsible for writing and managing a portfolio of equities with covered calls sold on a portion of the holdings.

Investors who buy shares of this ETF pay a management expense ratio (MER) for exposure. In return, they received the capital appreciation from the underlying shares and distributions from the covered calls.

Our covered call ETF's write monthly at-the-money call options on 25% of their underlying holdings, which consists of an equally weighted stocks in different market sector.

ETF | Ticker(s) | Option Yield1 | Dividend Yield2 | Indicative Yield | MER |

TXF / TXF.B / TXF.U | 9.52% | 1.97% | 11.49% | 0.71% | |

NXF / NXF.B / NXF.U | 9.50% | 5.87% | 15.37% | 0.72% | |

FHI / FHI.B / FHI.U | 4.52% | 1.89% | 6.41% | 0.71% |

Source: CI Global Asset Management, as of August 31, 2022.

1 Gross Option Premiums represent those received on August 19, 2022

2 As of September 2, 2022. The Current Dividend Yield represents the gross yield on the ETF’s underlying portfolio of securities. It is not the yield or the distribution investors will receive by virtue of an investment in the ETF.

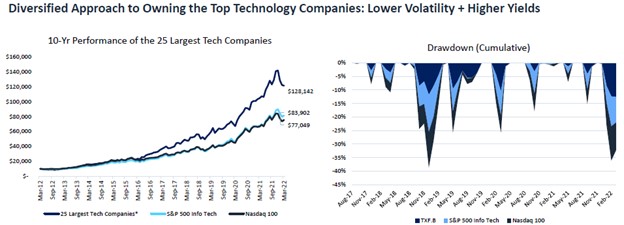

CI Tech Giants Covered Call ETF (TXF / TXF.B / TXF.B)

Mega-cap tech stocks suffered losses recently as interest rates rose amid less-than-stellar earnings reports. The sector has been highly volatile recently, with the tech-heavy Nasdaq 100 Index down over -29% YTD (as of May 24th, 2022)amidst a bear market.

Holding TXF can provide exposure to the growth of mega-cap tech stocks while still providing downside protection. When volatility trends higher, TXF's distribution yield increases thanks to the higher premiums received from the covered call overlay.

Source: Morningstar Direct and CI GAM. Period from April 1, 2012 to March 31, 2022. Performance in CAD.

*Based on the holdings of TXF.B. “Technology company” means an issuer classified within either the “Information Technology” Global Industry Classification Standard (GICS) sector or the “Internet & Direct Marketing Retail”, “Interactive Home Entertainment” and “Interactive Media & Services” GICS sub-industry groups, but excluding those in the “Data Processing & Outsourced Services” GICS sub-industry group, provided however, that the determination of what constitutes a technology company shall be at the sole discretion of the Portfolio Manager.

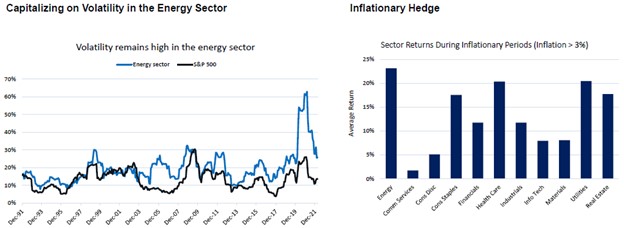

CI Energy Giants Covered Call ETF (NXF / NXF.B / NXF.U)

Soaring commodity prices and rising inflation have led to an energy sector resurgence. After falling in 2020 during the COVID-19 pandemic, energy staged a strong comeback to become the best-performing sector year-to-date.

Volatility remains high, making the 15 global energy stocks held by NXF excellent for a covered call strategy. Coupled with the already high dividend yields of many energy stocks, implementing a covered call overlay can significantly enhance income potential, while outpacing inflation.

Source: Morningstar Direct. Rolling annualized volatility on a monthly basis. Data period from Jan 1992 to Mar 2022. Source: Morningstar Direct. Performance in USD. Period from 1990 to 2021. Based on S&P 500 sectors with the exception of Real Estate. Real Estate = FTSE NAREIT All Equity REITs Index.

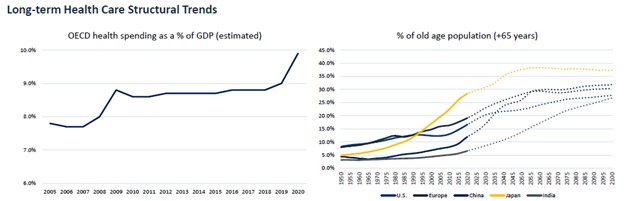

CI Health Care Giants Covered Call ETF (FHI / FHI.B / FHI.U)

An aging world population and increased healthcare expenditures has poised the healthcare sector to grow strongly over the next several decades. Advancements in biotechnology, genomics, and the Internet of Health Things (IoHT) may dramatically accelerate this trend.

Healthcare companies can maintain profitability even during recessions thanks to inelastic demand and the essential nature of their products and services. During the COVID-19 crash, the healthcare sector fell by 10.8%, less than the MCSI World Index at 20.1%.

(LHS) Source: OECD Health Statistics 2021

(RHS) Source: United Nations – Population Division

Are covered call ETFs a good investment for you?

Covered call ETFs offer a great way to enhance income, minimize risk, and still participate in the upside. With the current higher-then-average market volatility, options premiums have increased, which enhances yields. In a sideways trading market, our covered call ETFs can be an excellent tactical solution.

About the Author

Nirujan Kanagasingam is SVP, Head of Investment Advisory and ETF Strategy at CI Global Asset Management. In this role, he oversees three core functions: the Institutional Portfolio Management team, ETF Strategy, and Investment Portfolio Advisory.

Nirujan is responsible for advancing the growth of CI’s investment platform by partnering closely with the distribution team, as well as retail and institutional clients, to deliver portfolio insights and product expertise. Previously, Nirujan led the firm’s ETF business, where he played a key role in product management, indexing, factor research, ETF portfolio development, and the launch of numerous ETFs in the Canadian marketplace.

Nirujan holds a Bachelor of Commerce in Finance and Accounting from Ryerson University and is a CFA Charterholder.

IMPORTANT DISCLAIMERS

Commissions, management fees and expenses all may be associated with an investment in exchange-traded funds (ETFs). You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on recognized Canadian exchanges. If the units are purchased or sold on these Canadian exchanges, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. Please read the prospectus before investing. Important information about an exchange-traded fund is contained in its prospectus. The indicated rates of return are the historical annual compounded total returns net of fees and expenses payable by the fund (except for figures of one year or less, which are simple total returns) including changes in security value and reinvestment of all dividends/distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. ETFs are not guaranteed; their values change frequently, and past performance may not be repeated.

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies.

Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management has taken reasonable steps to ensure their accuracy. Market conditions may change which may impact the information contained in this document.